green card exit tax rate

The 8 years are. An exemption amount 699000 for expatriations in 2017.

Irs Amnesty Programs For Late Filers Expat Tax Professionals

It is taxed at either 0 15 or 20 depending on your income.

. If Green Card status commenced in 2013 or earlier there is an exit charge in 2020 as. Another important trigger for taxation upon the termination of a Green Card is the certification test. Citizens who have renounced their citizenship and long-term residents as defined in IRC 877 e who have ended their US.

Underpayment of taxes can result in fees ranging from 20-40 of owed taxes depending on the circumstances and severity of the underpayment. When a US person gives up their green card it can be a very complicated ordeal from an IRS tax perspective. The Basics of Expatriation Tax Planning.

The Exit Tax Paperwork. For 2019 the net gain that you otherwise must include in your income is reduced but not below zero by 725000. It is taxed at either 0 15 or 20 depending on your income.

Predictably the exit tax rules have spawned special-purpose tax forms. They remain subject to US Income Tax but cannot afford to surrender the card because of. The Exit Tax is computed as if you sold all your assets on the day before you expatriated and had to report the gain.

The Exit Tax Paperwork. In fact it does not even require that the green card holder was a permanent resident for the full 8-years or that they resided within the US. Long-term residents who relinquish their US.

The IRS then takes this final gain and taxes it at the appropriate rates. The 8-out-of-15-year test is satisfied. Different rules apply according to.

The tax is reduced by any foreign gift or estate tax paid on such gift or bequest. Giving Up a Green Card US Exit Tax. Citizenship and Immigration Services USCIS issued you a.

Eligible deferred compensation items. Predictably the exit tax rules have spawned special-purpose tax forms. The Exit Tax Planning rules in the United States are complex.

US Exit Tax Giving Up a Green Card. From an immigration perspective it is relatively straightforward the person usually files a Form I-407 by mail and waits for approval. During the citizenship application process you will be asked if you have paid taxes.

That means you have to pay a 40 percent tax rate on all undisclosed assets. You generally have this status if the US. You are a lawful permanent resident of the United States at any time if you have been given the privilege according to the immigration laws of residing permanently in the United States as an immigrant.

Exit tax applies to United States expatriates a term describing people who have renounced their US citizenship and those who have renounced a Green Card that they have held for at least eight years. The exit tax is also imposed on green card holders who have held a green card for 8 out of the last 15 years referred to as long-term residents. Form 8854 is the main tax form.

This is known as the green card test. For Federal Income Tax purposes a long-term permanent resident is deemed to have disposed of hisher world-wide assets at their fair market value the day prior to the expatriation. Ineligible deferred compensation items.

Failure to file a tax return as a green card holder is punishable by fees of 5 of the total owed balance of taxes compounding up to 25 for continued failure to pay. 200000 71100 128900. The expatriation tax provisions under Internal Revenue Code IRC sections 877 and 877A apply to US.

This amount is indexed for inflation is applied and any net capital gain above the exemption amount is taxed using the usual capital gain tax rates. Generally it takes a few months to hear back. The HEART Act also added the inheritance tax a 40 flat tax on the gross value of a covered gift or covered bequest made to a US.

The tax is imposed only to the extent the recipient receives covered gifts and bequests during the calendar year valued in excess of the annual gift tax exclusion which is 13000 in 2010. The Green Card Exit Tax 8 Years analysis is comprehensive. Green Card Holders and the Exit Tax.

Exit Tax and Expatriation involve certain key issues. Relinquishing a Green Card. If the department discovers failure to pay you will be forced to pay current and.

This amount is indexed for inflation is applied and any net capital gain above the exemption amount is taxed using the usual capital gain tax rates. Underpayment of taxes can result in fees ranging from 20-40 of owed taxes depending on the circumstances and severity of the underpayment. An exemption amount 699000 for expatriations in 2017.

This can mean that green card holders who have not formerly surrendered the green card are stuck. The mark-to-market tax does not apply to the following. Currently net capital gains can be taxed as high as 238 including the net.

IRS tax rules for expatriation from the United States requires a complicated tax analysis to determine if the expatriate must pay US. Form 8854 is the main tax form. The exit tax is generally payable immediately ie April 15 following the close of the tax year in which expatriation occurs.

If a Green Card Holder has been a permanent resident for at least 8 of the past 15 years they become subject to expatriation tax laws as well. In summary when giving back your Green Card or renouncing your US citizenship it is important that you understand that you. The exit tax is also imposed on green card holders who have held a green card for 8 out of the last 15 years referred to as long-term residents.

Resident status for federal tax purposes. The tax could be as high as 45 percent of the value of the gift or bequest. Tax evasion and conspiracy to defraud.

Nonresidents Think You Are Safe From U S Gift And Estate Taxes Think Again The Wolf Group

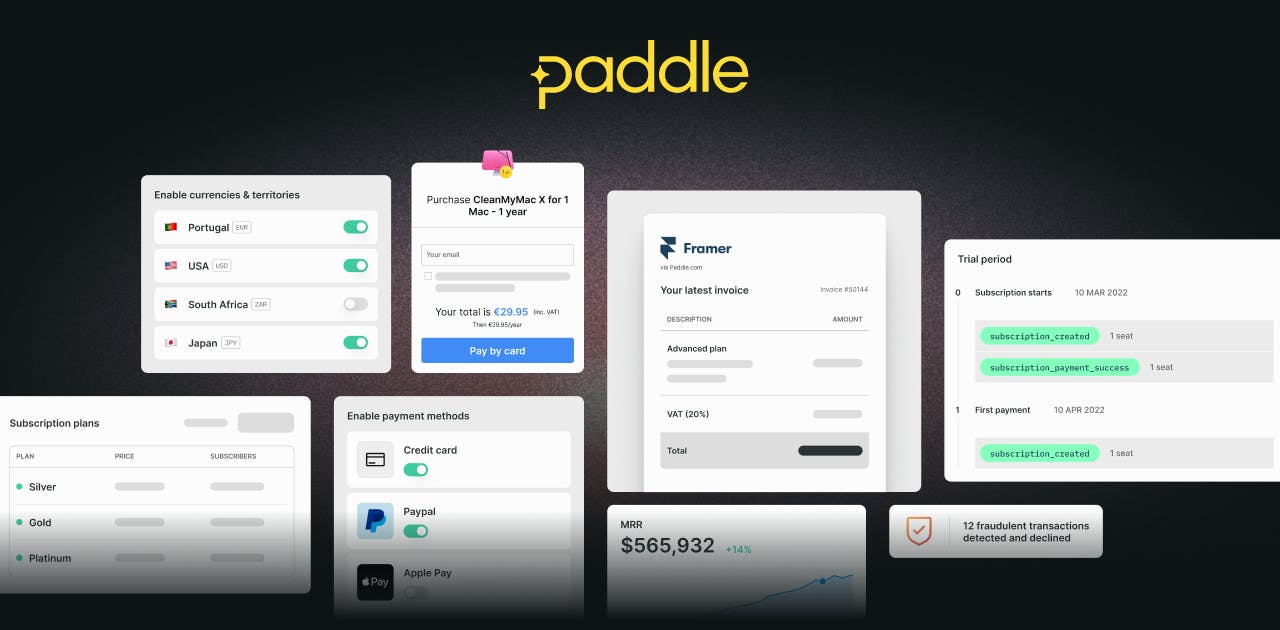

Paddle Help Center Which Countries Does Paddle Charge Sales Tax Or Vat For

Green Card Exit Tax Abandonment After 8 Years

Us Tax Residency Status Explained Resident Or Nonresident

How Is My Canadian Rrsp Taxed In The U S

Us Tax Residency Status Explained Resident Or Nonresident

Us Taxes Explained For J 1 Research Scholars Professors

Nonresidents Think You Are Safe From U S Gift And Estate Taxes Think Again The Wolf Group

Denmark Individual Other Taxes

![]()

Japan S Exit Tax Sme Japan Business In Japan

Receiving An Inheritance From Abroad Special Considerations For U S Taxpayers Round Table Wealth

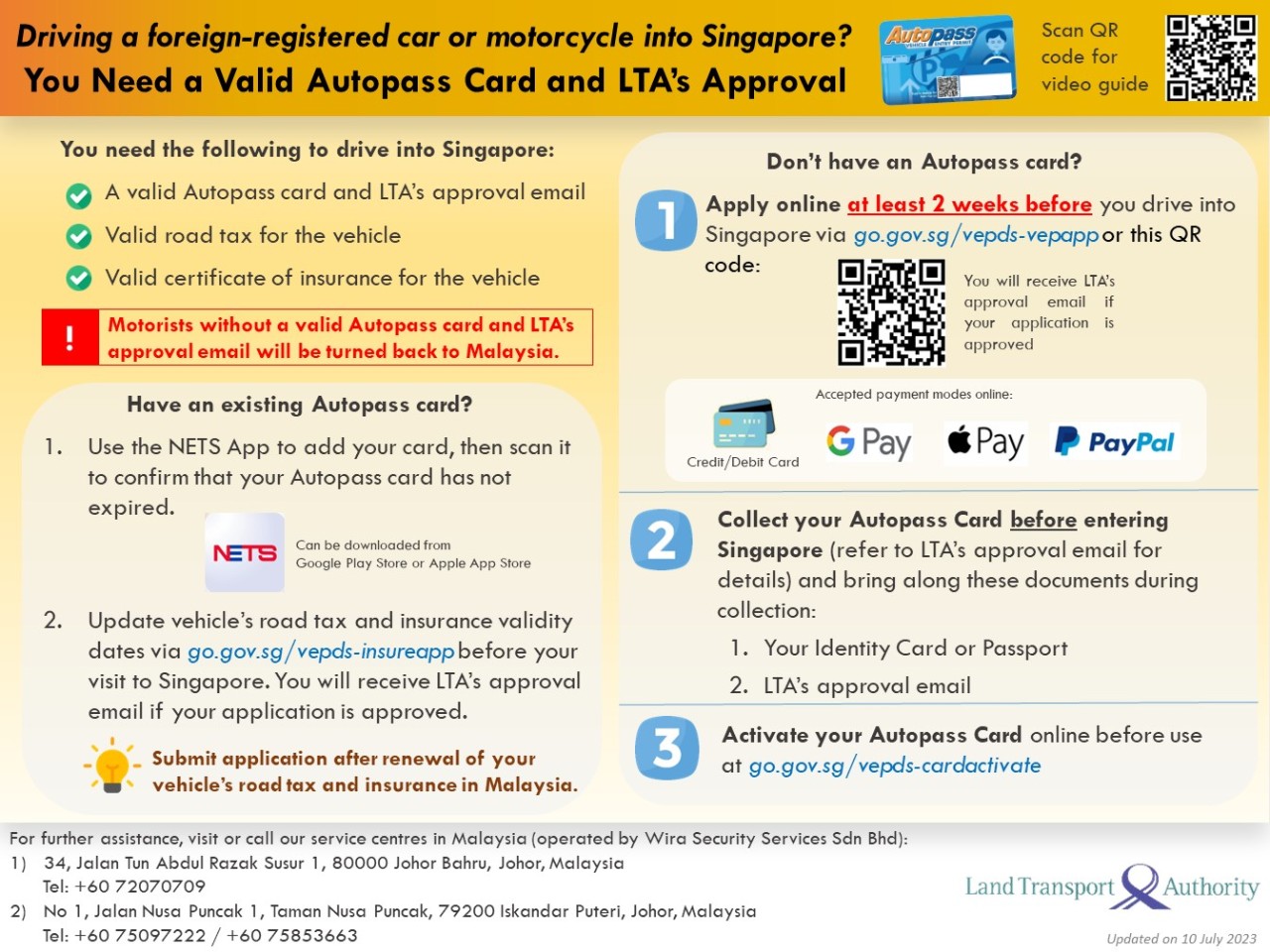

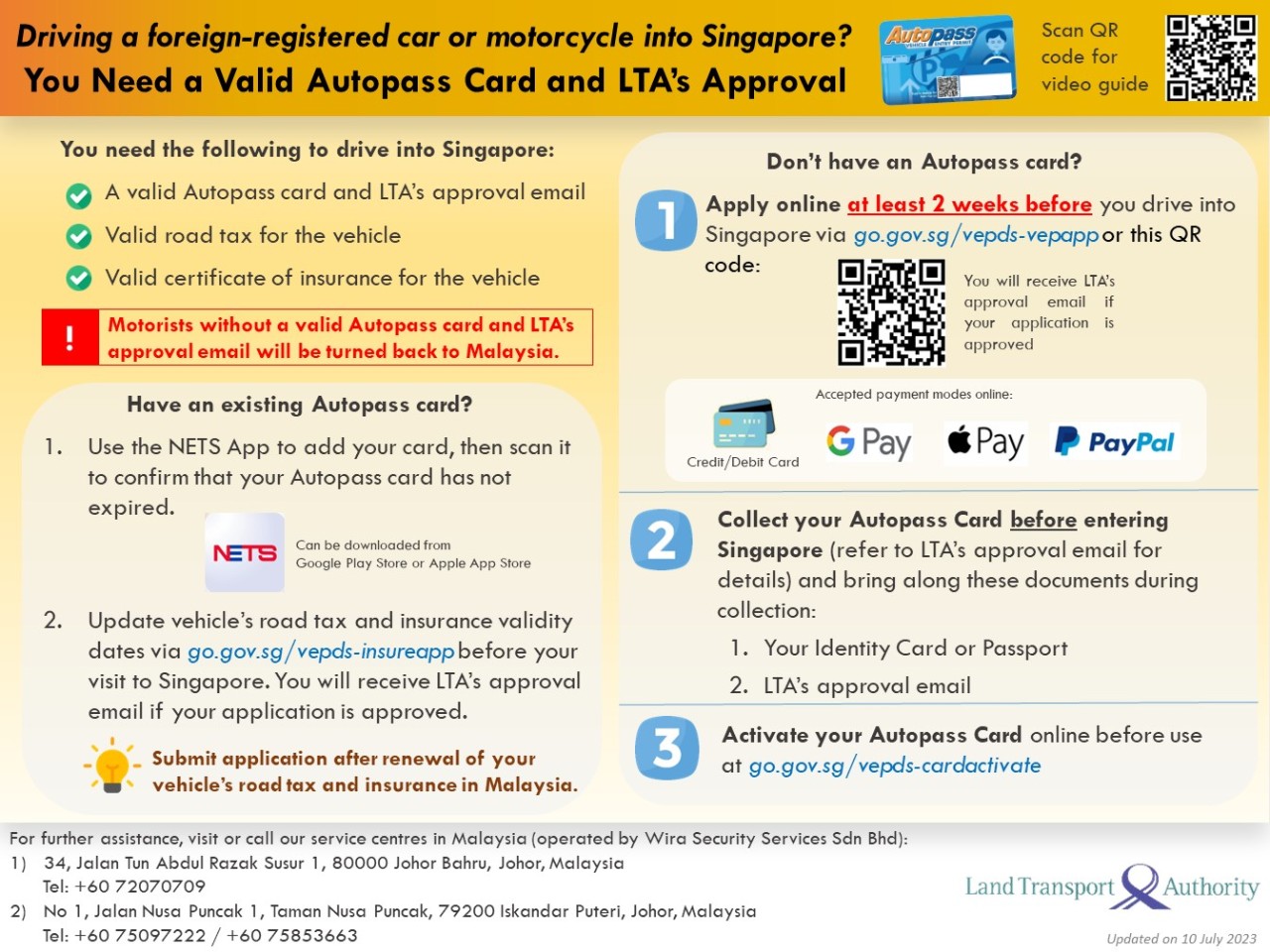

Lta Cars And Motorcycles Registered In Malaysia

California S Exit Tax Explained

F 1 International Student Tax Return Filing A Full Guide 2022

Expatriation Relinquishing Your Us Citizenship And Green Card